But really solar may be the future, but we have to deal with extremely harmful carbon and other air and water pollution now. You have to assume that marginal costs are equalized across sources by arbitrage, same for marginal benefits. The linked article was great. Here’s the relevant graph: Whoa, nuclear looks great!

From Wikipedia, the free encyclopedia

What affects the profitability of an unclear in nuclear energy? What are the risks? Energy researcher and analyst Schalk Cloete presents his latest paper on the matter. He looks at the various effects on nuclear power investment, including the rise of other competing renewable energy sources, and the changing price of energy. If you have an article you want to submit to us for consideration, click .

Read more by Noah Smith

Energy Return on Investment EROI is a ratio of the amount of energy exergy obtained from an energy resource to the amount of energy exergy expended to produce that energy. The energy return on investment EROI is a key determinant of the price of energy because sources of energy that can be tapped relatively cheaply will allow the price to remain low. EROI is important because if the cost of an energy plant is more than the revenues gained from selling electricity, that plant is not economically viable. EROI can also help organizations and governments determine which systems are more profitable than others. Solar power or nuclear power, for example. When the EROI is large, that means that producing energy from that source is relatively easy and cost-effective.

What affects the profitability of an investment in nuclear energy? What are the risks? Energy researcher and analyst Schalk Cloete presents his latest paper on the matter. He looks at the various effects on nuclear power investment, including the rise of other competing renewable energy sources, and the changing price of energy. If you have an article you want to submit to us for consideration, click. The analysis will be presented for a typical developed world scenario.

Developing world technology cost levels are very different and will be covered in a future article. All the most influential assumptions will be clearly explained and their impact on the results will be quantified in a sensitivity analysis. This will give the reader the opportunity to clearly see the quantified impact of the risk under the assumptions they think are the most appropriate.

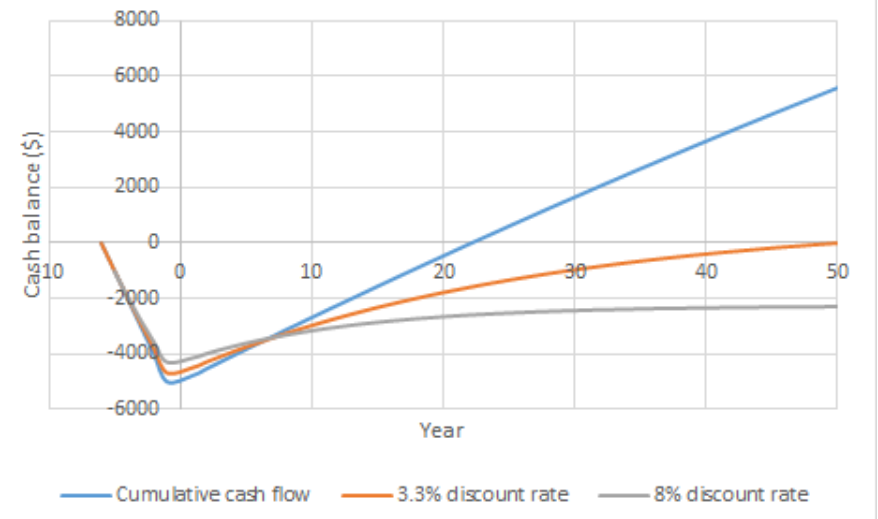

Results will be presented in the form of a discounted cash flow analysis for only 1 kW nuclear power over a five year construction period followed by a 50 year operating period. Using this information, a cumulative cash flow curve can be constructed. When a discount rate of 3. Next, the effect of expanding variable nucllear energy VRE market share over the plant lifetime is explored. Losing out on only the lowest price electricity sales will increase average sales prices.

Fuel costs also decline with the capacity factor. The cumulative cash flow analysis shows only minor differences due to these two competing effects, although the economic performance is worsened slightly. The effect of discount rate on the average electricity price required is shown below where several different risks related to nuclear power investment are explored.

This measure can be interpreted as the average market price over an entire year that will yield a zero return on investment with a specified discount rate. When the discount rate is set to higher values, the capital-intensive nature of nuclear power combined with its long construction time drive up the average electricity price required to break.

Early retirement of the plant after 30 years instead of 50 years only had a significant effect at low discount rates. When the discount rate is increased, the plant performance after 30 years of operation is strongly discounted, making the effect of early plant closure negligible. A significant increase in capital costs worsened the plant economic performance even more at high discount rates.

Finally, a delay in plant completion from 5 years to 7 years only showed a significant effect at high discount rates. When the time value of money is high, a significant delay jnvestment the time when the plant starts to produce revenue has a substantial effect on overall project economics. Next, the four risks discussed in the previous section will be quantified in a o analysis. Early retirement of the plant has a larger effect, especially in the extreme case where the plant is retired after only 20 years of operation.

Finally, a construction delay had almost no effect on the investment return. When low returns are expected as is the case herethe time value of money is low, meaning that a delay in revenues is not a problem. In general, I was quite surprised by the low enegy of sensitivity of the expected investment returns in this risk analysis. As shown in the previous articles discussing wind and solar power, the risks facing those technologies have much larger negative effects on investment returns.

This article has quantified the impact of typical nuclear power risks on expected investment returns. Although the risks are relatively low, the calculated annualized investment return of 1. Nuclear power will need to find a way to substantially reduce its costs before it can become economically attractive next to alternatives.

At this capital cost, the expected annualized return under the base case assumptions jumps to 5. Nuclear power therefore remains an interesting clean energy option, although its costs will have to decline significantly before it can present a compelling case for investment. At the current global average price point, nuclear power remains at the mercy of politicians because its economic case is not strong enough to facilitate pure market-driven deployment.

This article is published by kind permission of the author. Schalk is working on a series of risk analyses which will be published on Energy Post soon. My work on Energy Post is focused on the great 21st century sustainability challenge: quadrupling the size of the global economy, while reducing CO2 emissions to zero. I seek to contribute a consistently pragmatic viewpoint to the ongoing debate on this crucial topic. My formal research focus is on second generation CO2 capture processes because these systems will be ideally suited to the likely future scenario of a much belated scramble for deep and rapid decarbonization of the global energy.

What is missing is a analysis how the value of nuclear power declines at higher shares inevstment nuclear power. The same effectalalysid in the analysis of wind and solar was ignored. This effect stopped further expansion of nuclear in france. Nuclear power produces the same output during times of high and low wholesales prices. Therefore, nuclear will only start to see value declines when the market share becomes so high that nuclear alone regularly supplies the entire load.

France operates a portfolio plants energy return on investment nuclear economics of that are different to single plant ownership. Reactors that are not required to run baseload in France tend to be older plants where the costs have been written down so the marginal costs of production is low. EDF has not stopped building new reactors because of value decline.

Many being German renewable utilities that started an operation in France. So EDF no longer makes excellent profits and has little reserves. So EDF concentrates on life extensions of their older more dangerous models. France will adjust no doubt to a system comprising renewablesnuclear and gas fired plants. Like the UK has. Recently it eneegy decided to close Fessenheim in before the EPR would start…. Storing such gas is cheap in earth cavities. Hmm I doubt the last paragraph.

When electric heatings start pulling a lot of power, so at cold days, France regularily runs invextment of power and relys heavily on imported power.

They pay every price then to get power. The highest risk was not discussed: The politicians or rather the public making the power plant owners fully pay for their own waste disposal and insure the plant at market prices.

As with CO2 and air pollution in case of fossil fuels, external costs are all true costs that have to be paid by someone eventually. Both wind and solar produce power at inveshment and low wholesale-prices the prices buclear would be there when they would not roduce. And both lower the prices when they produce. Nuclear does not correlate with load, wind and solar correlate with demand.

So Wind and solar deliver preferabley at times of higher prices, and lower it. Nuclear produces always, and lowers always the power prices.

See the low capacity usage in france especially during summerand lowers the prices towards fuel costs during night as wind does it during strong storms wich do not happen every nightor solar durig sunny weekend days rreturn late spring. French nuclear does not earn significant money during most nights in the summer half of the year.

No, wind nuclaer solar output correlates with the weather, which is vague and difficult to predict with any accuracy more than a few days in advance. Dispatchable demand can correlate juclear the weather and dnergy gluts, but there is not much of that at present.

Seems some learning about korrelation is neccesary. Human power demand also correlates with weather. People are more active with dailight, and consume more power, and at cold windy days power consumption for heating is higher than at windless warm summerdays. Wind and solar power production might also correlate with Nigel Wests mood, the worse his mood the more power output of renewables, I could imagine. But I can also imagine the causality is from the power output to the mood, since Nigel West does not like renewable power as imvestment.

Comments What is missing is a analysis how the value of nuclear power declines at higher shares of nuclear power. Energy Post platform — register Platform user log-in not premium. Popular posts The 7 battery technologies that can be cost competitive by for EVs to grids 2, views posted on November 1, 10 Carbon Capture methods compared: costs, scalability, permanence, cleanness 2, views posted on November 11, EVs should be getting cheaper.

Recent Posts. This site uses cookies, for a number of reasons. By continuing to use this website you accept the use of cookies. Find rteurn .

Why Invest in Nuclear Energy & Uranium Mining?

Brown coalOpen-cast [31]. These are complex questions evading simple answers. Green Tech Green tech is technology that is considered environmentally friendly based on its production process or supply chain. The EROI might only include the fuel for the truck that delivers it from the mine to reactor. The issue is still subject of numerous studies, and prompting academic argument. Your Money. Anon: No No No! By using this site, you agree to the Terms of Use and Privacy Policy. Bibcode : pvse.

Comments

Post a Comment